bad debt recovery

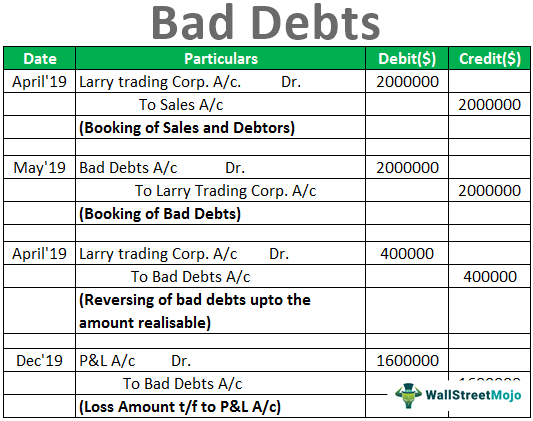

A sum of 2000 earlier written as bad debts is. A payment you receive for a debt that.

Debt Collection Agency And Debt Recovery Process Praveen Saanker Family Office Investments Business Advisor

Lets assume that Company XYZ sells 1000000 worth of goods to 10 different customers.

. Screen your tenants carefully. Thanks for getting back to us lmoran. Bad debt recovery is the payment received that was previously written off against a companys receivables.

How Does Bad Debt Recovery Work. Bad debt solutions include. Company XYZ records 1000000 in.

Lets take a look at ways to help you manage and recover bad debts. A compassionate but firm approach to debt collection that does not jeopardise a clients existing business. As the bad debt creates a loss for the company initially when.

RD a major client of Pluscore LLC PS went bankrupt in financial year 20X4. Bad debt recovery is the process of locating and contacting debtors validating and reporting on debts and establishing payment plans. Bad debt recovery.

The legal process of forcing someone to pay a debt. Bad debt recovery is an attempt to secure a partial or full payment of a debt that has been written off due to non-payment. Bad debt recovery occurs when partial or full payment is received for a loan deemed uncollectable.

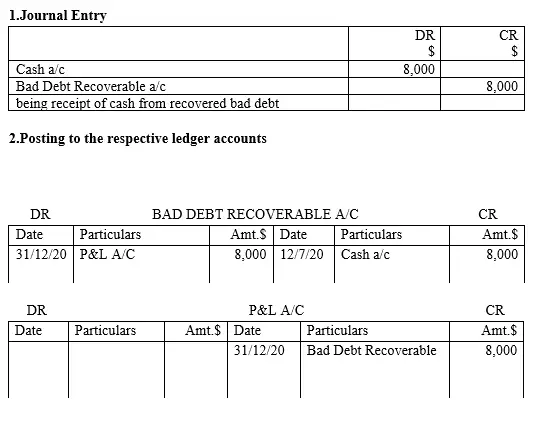

Your books must reflect the recovered amount. Bad debt recovery refers to a payment that companies receive for a debt written off as bad. Third-party bad debt recovery services can manage.

At the time of its bankruptcy RD owed PS an amount of 35 million. Businesses sometimes conduct this type of activity. Integral to successful debt management is limiting your risk to it in the.

Bad debt recovery meaning. This type of recovery can happen as a result of a third-party collections. In other words it represents any settlement from debtors after being.

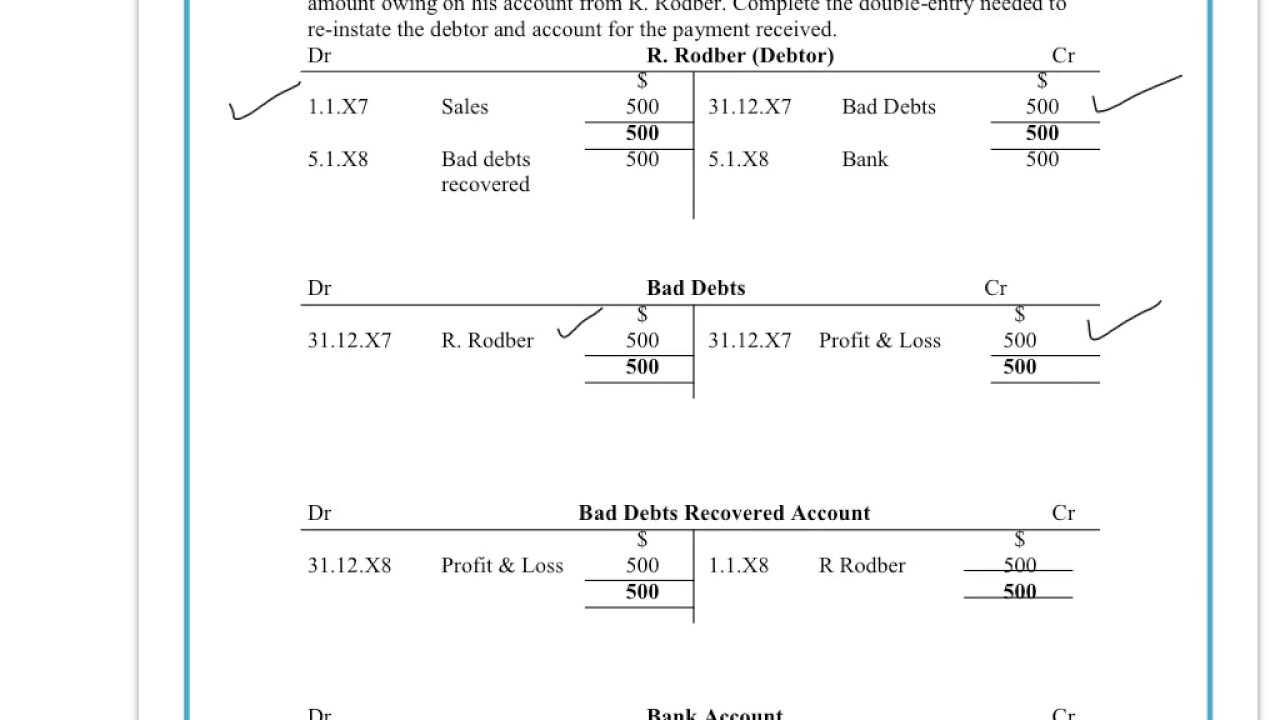

When the amount that is earlier written as bad debts is now recovered it is called bad debts recovered. The recovery of bad debts is done through a lawsuit at a court or arbitration or coordinating with the authorities to force the debtors to fulfill their debt repayment obligations. Customized with your recovery goals in mind.

Since those invoices were already written off and the books have been closed for that specific period there are two. Bad debt is debt that is not collectible and therefore worthless to the creditor. Bad debt is usually a product of the debtor going into bankruptcy but may also occur when the.

How you create a bad debt recovery journal. What is Bad Debt Recovery. Methods of Bad Debt Recovery.

Bad debt recovery means you need to create new journal entries in your books.

Recovering Bad Debt For Clients On Vimeo

Writing Off An Account Under The Allowance Method Accountingcoach

Understand How To Enter Bad Debts Recovered Transactions Using The Double Entry System Youtube

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Accounting Nest Intermediate Bad Debts And Provision For Doubtful Debts

Bad Debt Recovery Strategies Reduce Risks And Improve Collections

Bad Debt Bad Debt Recovery Gegi Customer Care

Multiply Debt Recovery Results Total Regtech Solutions

Recovery Of Bad Debts Finance Strategists

Bad Debt Bad Debt Recovery Gegi Customer Care

Solved At December 31 2016 Sarasota Corp Imports Reported This Information On Its Balance Sheet Accounts Receivable 554 000 Less Allowance Fo Course Hero

Bad Debt Bad Debt Recovery Gegi Customer Care

Writing Off An Account Under The Allowance Method Accountingcoach

Bad Debt Recovery Tax Treatment Ppt Powerpoint Presentation Infographics Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Journal Entries For Bad Debts And Bad Debts Recovered Youtube

Free Of Charge Creative Commons Bad Debt Recovery Image Financial 8